Mortgage Market Remains Calm

Given the significant economic news last week, mortgage markets were surprisingly quiet. The rare suspense heading into the Fed meeting produced little reaction after the decision came out. The major economic data also had just a minor impact. Mortgage rates ended last week slightly higher but remain near the lowest levels since early 2023.

50 Basis Point Cut From Fed

Just ahead of a Fed meeting, investors generally agree on what they expect the Fed to do. Last Wednesday’s meeting was a rare exception, however, as investors were nearly evenly divided about what size the rate cut would be. The Fed opted for a larger 50 basis point rate reduction rather than one of just 25 basis points, bringing the federal funds rate down to a range of 4.75% to 5%. According to the statement released after the meeting, officials judge that the risks to their employment and inflation goals are “roughly in balance.” In short, they have made substantial progress in their battle against inflation, reducing the need for highly restrictive monetary policy, which could slow the economy more than necessary. The “dot plot” forecasts from officials project that there will be another 50 basis points of rate cuts before the end of this year and an additional 100 basis points in reductions by the end of 2025. One reason that the reaction to the news of the larger rate cut was muted was that the long-term outlook of officials for the federal funds rate was close to the levels anticipated by investors. That endpoint is more significant to investors than the precise pace at which the Fed gets there.

Retail Sales Rise

After a much greater than expected surge in July, the latest report indicated that consumer spending has returned to more normal levels. In August, Retail sales rose 0.1% from July, above the consensus forecast, and were 2.1% higher than a year ago. Strength was seen in sporting goods and building materials, while clothing and furniture displayed weakness.

Existing Home Sales Slip

In the housing sector, sales of existing homes in August fell a little from July and were 4% lower than a year ago. The median existing home price of $416,700 was up 3% from last year at this time. Inventories remain stuck at historically low levels, standing at just a 4.2-month supply nationally, far below the 6-month supply typical in a balanced market. From a different perspective, though, inventories were 23% higher than a year ago.

Housing Starts Rebound

Last month, the impact of Hurricane Beryl helped push housing starts down to the lowest level since the middle of 2020. The effects proved to be temporary, however, as the most recent results revealed that the rebound was even stronger than expected. In August, overall housing starts jumped 10% from July, far exceeding the consensus forecast. Single-family housing starts surged an even greater 16% from July and were 5% higher than a year ago. Single-family building permits, a leading indicator of future construction, also increased significantly more than forecasted.

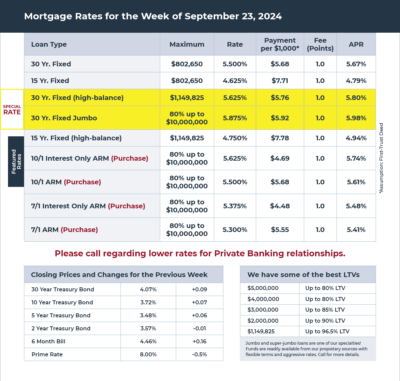

Mortgage Rates for the week of 9-23-2024