Investors Eye Fed’s Next Move

During a light week for economic reports, investors were focused on a highly anticipated speech by Fed Chair Powell. All signs indicate that Fed officials are ready to begin cutting the federal funds rate soon. As a result, mortgage rates ended last week a little lower, near the lowest levels of the year.

Powell Hints at Rate Cuts

In a speech last Friday, Fed Chair Powell said that “the time has come” to loosen monetary policy. The reasons he cited included that inflation has declined “significantly” and the labor market is “no longer overheated.” He added that the timing and pace of rate cuts will be determined by incoming economic data.

Investors Anticipate Reduction

The minutes from the July 31st Fed meeting released on Wednesday suggested that other officials have similar views on the appropriate direction for future monetary policy. Pointing to progress on inflation and increases in the unemployment rate, a small number of officials were ready to cut rates at this meeting, while the “vast majority” indicated that it would “likely be appropriate” at the next one. Investors now anticipate that there will be at least a 25 basis reduction in the federal funds rate in September, which would be the first easing since early in the pandemic.

Housing Market Sees Mixed Signals

In the housing sector, sales of existing homes in July rose slightly from June, the first gain in five months, but still were a little lower than a year ago. The median existing-home price of $422,600 was up 4% from last year at this time. Inventory levels remain stuck near historic lows, standing at just a 4.0-month supply nationally, far below the 6-month supply typical in a balanced market. From a different perspective, though, inventories were 20% higher than a year ago.

Home-Building Hits New Low Since June 2020

The latest home-building data was disappointing, but a significant portion of the weakness can be attributed to the impact of Hurricane Beryl. In July, overall housing starts fell 5.5% from June, more than expected, to the lowest level since June 2020. Single-family housing starts dropped for a fifth straight month to the lowest level since March 2023 and were 15% lower than a year ago. Single-family building permits, a leading indicator of future construction, also declined more than forecasted.

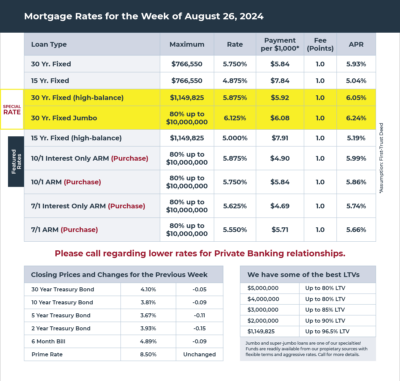

Mortgage Rates for the week of 8-26-2024