Mortgage Rates Hit New Low

The economic news was very favorable for mortgage markets last week. On Wednesday, the Fed meeting left the door open for looser monetary policy if the economy performs as forecasted. The major economic data released last Thursday and Friday fell far short of expectations, convincing investors that rate cuts will be seen in the near future. As a result, mortgage rates ended last week at the lowest levels of the year.

Fed Hints at Cuts

As expected, there was no reduction in the federal funds rate last Wednesday. The changes to the statement released after the Fed meeting, while relatively minor overall, were slightly dovish (favoring looser monetary policy). For example, officials expressed more concern about a weakening labor market rather than focusing almost exclusively on the battle to bring down inflation. During his press conference, Fed Chair Powell refused to be pinned down on the precise timing of a federal funds rate cut, but he was receptive to the first one taking place soon. Investors anticipate that rates will be lowered at the next meeting in September, with some predicting that it will be by a larger 50 basis points rather than the more common 25.

Jobs Report Disappoints

The latest Employment report revealed that the economy added just 114,000 jobs in July, far below the consensus forecast, and the results from the prior month were revised lower. The largest gains were seen in the healthcare, construction, and leisure sectors. Unexpectedly, the unemployment rate rose from 4.1% to 4.3%, the highest level since October 2021. Average hourly earnings were 3.6% higher than a year ago, also well below the consensus forecast and the lowest annual rate since May 2021.

Manufacturing Plunges

Another significant economic report released last week from the Institute of Supply Management also indicated unexpected weakness. The ISM national manufacturing index plunged to 46.8, far below the consensus forecast and the lowest level since July 2023. Since readings above 50 indicate an expansion in the sector and below 50 a contraction, the report suggests that this important segment of the economy is slowing.

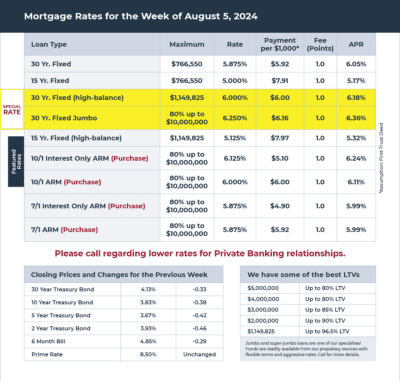

Mortgage Rates for the week of 8-05-2024