Favorable Week for Mortgage Rates

Major economic news last week was very straightforward and favorable for mortgage markets. The latest inflation data was lower than expected, causing rates to decline significantly.

Mortgage Rates 101

Inflation is negative for mortgage rates because it erodes the future purchasing power of money. For example, suppose a bank lends money to a home buyer at a fixed interest rate. The amount of dollars that will be repaid each year will be the same. The question for the bank is how valuable each dollar will be in the future. Inflation raises prices, meaning that one dollar can buy less. To compensate, banks set mortgage rates to offset the expected decline in purchasing power over time caused by inflation. As a result, if the outlook for inflation rises or falls, rates follow.

Core CPI Ups and Downs

The Consumer Price Index (CPI) is one of the most widely followed inflation indicators. To reduce short-term volatility in the reading and get a better sense of the underlying trend, investors and Fed officials often prefer to look at core CPI, which excludes the food and energy components. In June, core CPI was 4.8% higher than a year ago, below the consensus forecast and down sharply from 5.3% last month. This was the smallest annual rate of increase since October 2021.

Core CPI Inflation Rate Points Toward Possible Fed Rate Increase

While the battle against inflation took a solid step forward this month, there is still a long way to go. The core CPI annual rate has fallen from a peak of 6.6% in September 2022, but it remains far above the readings around 2.0% seen early in 2021, which is the stated target level of the Fed. Progress has been slow due to stubbornly high prices in certain areas of the economy. In particular, shelter (housing) costs remained elevated and again were responsible for the largest portion of the increase. By contrast, used vehicle prices and airline fares have been declining. To help further bring down inflation, investors anticipate that the Fed will increase the federal funds rate by another 25 basis points at the next meeting on July 26.

Major Economic News Due This Week

Investors will continue to watch for Fed officials to elaborate on their plans for future monetary policy. For economic reports, Retail Sales will come out on Tuesday. Since consumer spending accounts for over two-thirds of U.S. economic activity, the retail sales data is a key measure of the health of the economy. Housing Starts will be released on Wednesday and Existing Home Sales on Thursday.

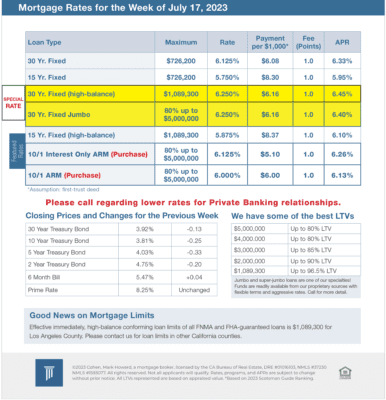

Mortgage Rates for the week of 7-17-2023