Mixed Inflation Data

Investors were focused on the inflation data last week, but the two big reports revealed mixed results. In testimony to Congress on Tuesday, Fed Chair Powell explicitly said that he is providing no new signals about the timing of future monetary policy, so his comments caused little reaction. The net effect of these events was that mortgage rates ended last week slightly lower.

CPI Trending Downward

The Consumer Price Index (CPI) is one of the most widely followed inflation indicators. To reduce short-term volatility and get a better sense of the underlying inflation trend, investors typically look at core CPI, which excludes the food and energy components. In June, Core CPI was 3.3% higher than a year ago, down from 3.4% last month, and the lowest annual rate of increase since April 2021.

Shelter Costs Remain Elevated

Although this annual rate has fallen from a peak of 6.6% in September 2022, it is still far above the readings around 2.0% seen early in 2021, which is the stated target level of the Fed. One big reason is that shelter (housing) costs remain elevated and again were responsible for the largest portion of the increase. However, the CPI data measures shelter costs with a lag, and more timely indicators from other sources suggest that this component will slowly come down later in the year. Also notable was that used vehicle prices declined 1.5% from May and were down 10% from a year ago.

PPI Miss

In contrast to CPI, another major inflation indicator released last week, which measures costs for producers, was significantly higher than expected. The core Producer Price Index (PPI) was 3.0% higher than a year ago, up from an annual rate of 2.6% last month and far above the consensus forecast. This was the highest annual rate since April 2023. Investors place less weight on PPI, since it reflects a smaller slice of the economy than CPI.

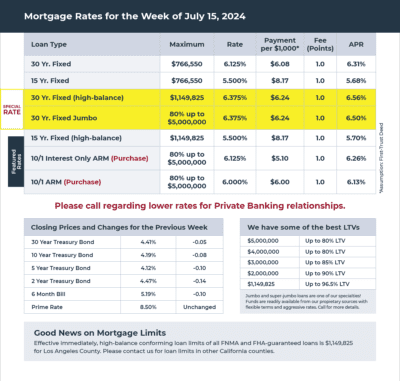

Mortgage Rates for the week of 7-15-2024