Labor Market Data

The major labor market data released last Friday exceeded the forecasts of economists. Despite this unexpected strength, however, investors think that the economy is slowing, and mortgage rates ended last week slightly lower.

272k Jobs Added

The economy added 272,000 jobs in May, well above the consensus forecast of 190,000. Particular strength was seen in the healthcare, leisure/hospitality, and government sectors. Another surprise was that the unemployment rate unexpectedly rose from 3.9% to 4.0%, the highest level since January 2022. Average hourly earnings were 4.1% higher than a year ago, above the consensus forecast, up from an annual rate of 4.0% last month.

Services and Goods

Two other significant economic reports released last week from the Institute of Supply Management provided a mixed message. The ISM national services sector index rose to 53.8, handily beating the consensus, while the national manufacturing index unexpectedly dropped to 48.7. Readings above 50 indicate an expansion in the sector and below 50 a contraction. Since the economy emerged from the pandemic, consumers have shown a preference for services over goods.

European Interest Rates

As expected, the European Central Bank (ECB) reduced benchmark interest rates by 25 basis points to 3.75%, down from a record 4% where it had been since September 2023. This was its first rate cut since September 2019. The statement released after the meeting again emphasized that future monetary policy decisions will be based on incoming economic data. Investors anticipate that there will be one more rate cut by the ECB this year.

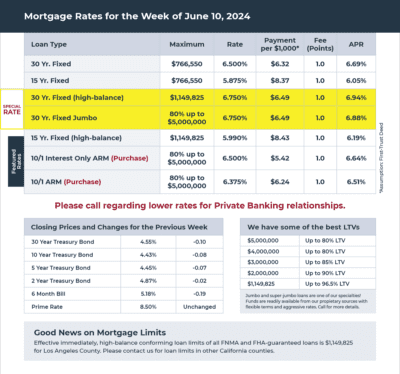

Mortgage Rates for the week of 6-10-2024