Mortgage Markets

With a lack of significant economic news, it was a very quiet week last week for mortgage markets. Investors essentially were on the sidelines waiting for the next big CPI inflation report on May 15. In the bigger picture, mortgage rates remain a little below their highest levels of the year.

Inflation Downward Trend Stalls

It makes sense that investors are hesitant to take action right now since the economic outlook is particularly uncertain. While there is always a divergence in forecasts from leading economists, the current range is unusually large. The primary focus continues to be on inflation. After coming down sharply from its peak for roughly a year and a half, the data so far this year has indicated that further progress has stalled. The big question is whether the downward trend is indeed over or whether this is merely a temporary pause. Only time will tell.

Wait and See Fed Attitude Keeping Investors Divided

Investors are similarly divided about the future path of consumer spending and the strength of the labor market. Despite major headwinds such as higher prices, consumer spending has remained surprisingly resilient, unexpectedly boosting GDP growth for several quarters. Now, however, cracks appear to be emerging, particularly for consumers at lower income levels who appear to be scaling back. The most recent reports on employment growth, job openings, and unemployment claims also suggest that the tight labor market may finally be easing a bit. As a result of the uncertainty, Fed officials have adopted a wait and see attitude before adjusting monetary policy, and investors have been reacting especially strongly to incoming economic data.

Unemployment Insurance Claims Above Forecast

The Department of Labor releases the total number of new claims for unemployment insurance each week. The latest reading was 231,000, above the consensus forecast and the most since August 2023. This was down sharply from the inflated figures seen during the early months of the pandemic, but in line with the levels which were typical during 2019. Weekly jobless claims are important because they are one of the timeliest indicators of labor market trends.

Major Economic News Due This Week

Investors will continue to watch for Fed officials to elaborate on their plans for future monetary policy. Wednesday will be the big day for economic reports with CPI and Retail Sales. The Consumer Price Index (CPI) is a widely followed monthly inflation indicator that looks at the price changes for a broad range of goods and services. Since consumer spending accounts for over two-thirds of U.S. economic activity, the retail sales data is a key measure of the health of the economy. In addition, Housing Starts and Import Prices will be released on Thursday.

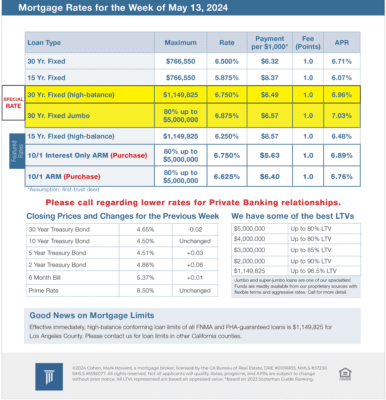

Mortgage Rates for the week of 5-13-2024