Mortgage Rates Rise

For the third week in a row, stronger than expected major economic data was unfavorable for mortgage markets. First it was job gains, then inflation, and now consumer spending which eclipsed forecasts. As a result, mortgage rates climbed again to the highest levels of the year.

Strong Consumer Spending

In March, retail sales rose an impressive 0.7% from February, far above the consensus forecast, and the results for the prior month received a significant upward revision as well. Strong gains were seen in a broad range of categories spanning online merchants, gas, and miscellaneous retailers. Despite higher prices and credit card rates, consumers remain surprisingly resilient.

Fed Not Rushing to Cut Interest Rates

As a result of the unexpected strength of the economy, Fed officials have been showing less support for loosening monetary policy. On last Tuesday, Chair Powell pointed out again that the data over the last few months has indicated a lack of progress in bringing inflation back down to the target level of 2.0% annually, meaning that they are in no hurry to begin cutting interest rates. This message was consistent with other recent comments from a wide range of Fed officials. Investors now anticipate that the first rate reduction will take place in September.

Low Inventory Levels

Sales of existing homes in March fell 4% from February, close to the consensus forecast, and were a little lower than last year at this time. Inventory levels remain stuck near historic lows, standing at just a 3.2-month supply nationally, far below the 6-month supply typical in a balanced market. The median existing-home price of $393,500 was up 5% from last year at this time, at a record high for the month of March. One interesting note is that purchases by first-time buyers rose to 32% of total sales from 26% last month, while purchases by investors dropped to 15% from 21%.

New Builds Remain Flat

Based on the latest data, the severe shortage of homes in many regions shows few signs of abating any time soon. In March, single-family housing starts dropped 12% from February, far more than expected. Single-family building permits, a leading indicator of future construction, fell to the lowest level since October. A separate survey of home builder sentiment on housing market conditions from the NAHB contained relatively better news as it remained flat from last month at an eight-month high.

Major Economic News Due This Week

Investors will continue to watch for Fed officials to elaborate on their plans for future monetary policy. They will also keep an eye out for signs of escalation in the conflict in the Middle East. For economic reports, New Home Sales will be released on Tuesday. Gross Domestic Product (GDP), the broadest measure of economic activity, will come out on Thursday. Personal Income and the PCE price index, the inflation indicator favored by the Fed, will be released on Friday.

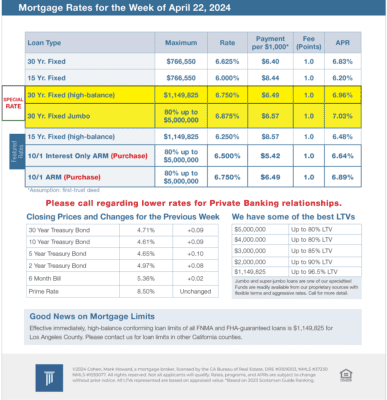

Mortgage Rates for the week of 4-22-2024