Puzzling Week for Mortgage Markets

It was a puzzling week last week for mortgage markets. Tariffs remained the primary focus for investors, and the latest news (see below) was major, but it did not appear to justify a huge selloff in bonds. Beyond that, the most recent inflation data was much lower than expected, a positive for mortgage markets. However, rates ended last week significantly higher.

Tariff Pause, Bond Yields Jump

Last Wednesday afternoon, President Trump announced that higher tariffs will be paused for 90 days for most countries, allowing time for negotiations, while tariffs on China will be raised significantly. Bond yields then climbed sharply last Thursday and Friday, although the reasons are not clear. One possibility is that investors are concerned that China may retaliate by selling its holdings of U.S. bonds. Foreign countries own about 15% of U.S. mortgage-backed securities (MBS), and the top two holders are Japan and China, meaning that it is possible. The question, though, is how likely it is to occur. Beyond this, there have been reports that some investment firms have been forced to sell bonds to raise funds to cover margin calls due to recent losses in the stock market. Finally, foreign investors may simply be selling U.S. assets due to the uncertainty, causing the value of the dollar to fall and bond yields to rise.

Core CPI Hits New Low

The Consumer Price Index (CPI) is one of the most closely watched inflation indicators released each month. To reduce short-term volatility and get a better sense of the underlying inflation trend, investors look at core CPI, which excludes food and energy. In March, Core CPI was 2.8% higher than a year ago, well below the consensus forecast and the lowest annual rate since March 2021.

Inflation Still Above Target

Although this annual rate is down significantly from a peak of 6.6% in September 2022, and from 3.9% in January of last year, it is still far above the readings around 2.0% seen early in 2021, which is the stated target level of the Fed. Shelter (housing) costs continue to be a primary reason why progress on bringing down inflation remains challenging. However, airline fares, prescription drug costs, and used vehicle prices dropped sharply in March.

Producer Inflation Eases

Another significant inflation indicator released last week, which measures costs for producers, also came in well below the expected levels. The March core Producer Price Index (PPI) fell 0.1% from January, far below the consensus forecast for an increase of 0.3%. It was 3.3% higher than a year ago, down from an annual rate of 3.4% last month. Of the two major inflation reports, investors tend to place less weight on PPI, since it reflects a smaller slice of the economy than CPI. Going forward, investors will be watching closely to see if higher tariffs exert upward pressure on inflation levels.

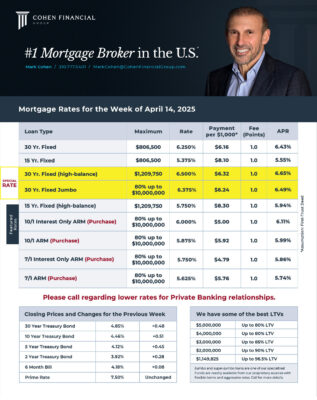

Mortgage Rates for the week of 4-14-2025