Mortgage Rates Steady

There was a lot of major economic data released last week, but there were few surprises. The key labor market data was very close to expectations, and the other reports were mixed. As a result, mortgage rates ended last week with little change.

February Job Growth

The key Employment report revealed that the economy gained 151,000 jobs in February, close to the consensus forecast of 160,000. Sectors displaying particular strength included health care, financial, and transportation. The unemployment rate unexpectedly increased from 4.0% to 4.1%. Average hourly earnings, an indicator of wage growth, were 4.0% higher than a year ago, down from an annual rate of 4.1% last month.

Services Up, Manufacturing Down

Two other significant economic reports released last week by the Institute of Supply Management revealed one miss and one beat. The ISM national services sector index rose to 53.5, above the consensus forecast. Conversely, the national manufacturing index declined to 50.3, falling short of expectations. Readings above 50 indicate an expansion in the sectors and below 50 a contraction. Service companies continue to outperform manufacturers.

Tariffs Add Uncertainty

Much of the recent volatility in financial markets has been due to changes in tariff policies. The impact of higher tariffs on mortgage rates is a bit tricky to determine, as there are offsetting factors. One direct effect, quite simply, is that tariffs raise prices, causing inflation. However, they also lower the outlook for global economic growth, which would reduce future inflationary pressures. Bottom line, the net long-term influence on mortgage rates will depend on the magnitude and duration of the new policies.

Europe Changes Policy

There were also a couple of significant economic events in Europe last week. On Thursday, the European Central Bank reduced benchmark interest rates by 25 basis points. This move was widely anticipated, and the reaction was relatively minor. A much bigger surprise, however, was a policy change in Germany. The German government announced plans to adjust its debt rules to allow higher fiscal spending to boost economic growth. Global bond yields climbed after this potentially inflationary news.

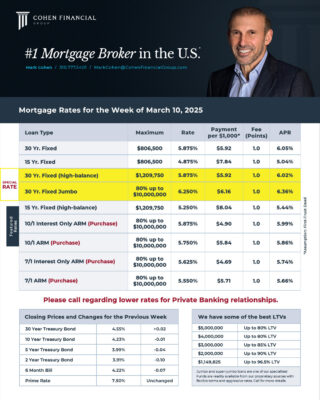

Mortgage Rates for the week of 3-10-2025