Core CPI Rises 3.3% Year-Over-Year in January

The Consumer Price Index (CPI) is one of the most closely watched inflation indicators released each month. To reduce short-term volatility and get a better sense of the underlying inflation trend, investors look at core CPI, which excludes food and energy. In January, Core CPI was 3.3% higher than a year ago, above the consensus forecast and the highest annual rate since May 2024.

Stubborn Inflation Persists as Housing and Auto Costs Surge

Although this annual rate is down significantly from a peak of 6.6% in September 2022, and from 3.9% in January of last year, it is still far above the readings around 2.0% seen early in 2021, which is the stated target level of the Fed. Shelter (housing) costs continue to be a primary reason why further progress on bringing down inflation remains challenging. In addition, used car prices, auto insurance, and hospital services posted large increases in January.

Producer Price Index Hits 3.6%, Highest Since Feb 2023

Another significant inflation indicator released last week, which measures costs for producers, was roughly in line with the expected levels. The January core Producer Price Index (PPI) rose 0.3% from December, matching the consensus forecast. It was 3.6% higher than a year ago, up from 3.5% last month and the highest annual rate since February 2023. Of the two major inflation reports, investors tend to place less weight on PPI, since it reflects a smaller slice of the economy than CPI.

Consumer Spending Slows

Consumer spending unexpectedly slowed sharply in January, possibly disrupted by bad weather and California wildfires. In January, retail sales plunged 0.9% from December, far more than the consensus forecast for just a slight decline. Particular weakness was seen in autos/parts, online outlets, and sporting goods/hobbies. The decline this month followed a strong holiday shopping season.

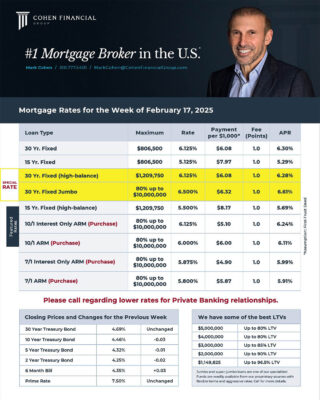

Mortgage Rates for the week of 2-17-2025