Investors have been on edge about higher inflation for months, and last Thursday they were hit with a powerful one-two combination that left them stunned. First, the CPI inflation report was even stronger than expected, and then a Fed official proposed a very rapid pace of rate hikes to bring down inflation. As a result, mortgage rates climbed to the highest levels in over two years and are more than 100 basis points higher than a year ago at this time.

Core CPI Hits a Record High

The Consumer Price Index (CPI) is a closely watched inflation indicator that looks at price changes for a broad range of goods and services. Core CPI excludes the volatile food and energy components and provides a clearer picture of the longer-term trend. In January, Core CPI was 6.0% higher than a year ago, above the consensus forecast, up from an annual rate of increase of 5.5% last month, and the highest level since 1982.

There are many reasons why the annual core inflation rate has jumped from the readings below 2.0% seen early in 2021, including a tight labor market, strong consumer demand for goods, rising energy prices, and supply chain disruptions. Shortages for many items have caused enormous cost increases, such as used car prices which are 41% higher than a year ago. Fed officials and economists are divided about how much the recent spike in inflation will subside as temporary factors caused by the pandemic are resolved.

Fed May Increase Pace of Tightening Monetary Policy

Due to the strong CPI inflation report last Thursday morning, investors raised their expectations for the pace of Fed tightening this year. Later that day, investors were hit with unexpectedly hawkish (in favor of tighter policy) comments from James Bullard, a Fed official. Bullard said that he would “like to see 100 basis points in the bag by July 1,” which would mean federal funds rate increases totaling a full point over the next three Fed meetings. Investors again raised their outlook for the pace of rate hikes after the comments and now anticipate a 50 basis point increase instead of a 25 basis point increase at the next meeting on March 16. Investors also expect the Fed to scale back its bond purchase program more quickly. Since this will reduce demand for bonds, including mortgage-backed securities (MBS), mortgage rates rose on the news.

Major Economic News Due This Week

Looking ahead, investors will closely follow news on the omicron variant and will look for additional Fed guidance on the pace of future rate hikes and balance sheet reduction. Beyond that, Retail Sales will be released on Friday. Since consumer spending accounts for over two-thirds of U.S. economic activity, the retail sales data is a key indicator of growth. Housing Starts will come out on Thursday and Existing Home Sales on Friday.

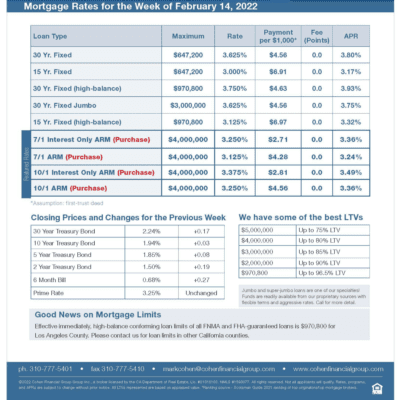

mortgage rates week of 2-14-2022