Strong Employment Proves Negative for Mortage Markets

There were two key economic events last week, and investors pushed mortgage rates lower in the days leading up to them. The Fed meeting on Wednesday contained no surprises and had little lasting impact. By contrast, the Employment report released on Friday was much stronger than expected, which was negative for mortgage markets. Despite the shocking labor market data, however, the net result was that mortgage rates ended last week slightly lower.

Unemployment Rate Remains Unchanged

In January, the economy added an enormous 353,000 jobs, far above the consensus forecast of 180,000 and the largest monthly gain since January 2023. In addition, the results for prior months were revised higher by 126,000. The largest gains were seen in professional services, healthcare, and retail trade. The unemployment rate remained unchanged at 3.7%, below the consensus of 3.8%.

Hourly Earnings Increased

Beyond the massive job gains, wage growth also vastly exceeded expectations. Average hourly earnings increased 0.6% from December, double the consensus forecast. Earnings were 4.5% higher than a year ago, up from an annual rate of increase of 4.3% last month and the highest level since February 2023. Fed officials keep a close eye on wage growth because it generally raises future inflationary pressures.

Manufacturing Index Above Consensus Forecast

Another significant economic report released last week from the Institute of Supply Management also revealed unexpected strength, at least relative to recent readings. The ISM national manufacturing index rose to 49.1, above the consensus forecast and the highest level since October 2022. Still, readings below 50 indicate a contraction in the sector, and this was the fifteenth straight month below 50, the longest streak in about 15 years.

No Change From Fed on Rates

As expected, the Fed made no change in rates. While some investors had hoped for specific guidance on the timing of rate cuts, officials again chose to retain flexibility to react to incoming economic data. The meeting statement noted that officials need “greater confidence” that inflation will fall to their 2.0% target before loosening monetary policy. Powell said that additional inflation readings consistent with recent trends would boost confidence, but he suggested that a rate cut at the next meeting in March is unlikely. Most investors now anticipate that the first rate cut will take place in May.

Major Economic News Due This Week

Investors will continue to watch for Fed officials to elaborate on their plans for future monetary policy. It will be a very light week for economic reports. The ISM national services sector index will be released on Monday and the Trade Deficit on Wednesday. Treasury auctions on Wednesday and Thursday also might influence mortgage markets.

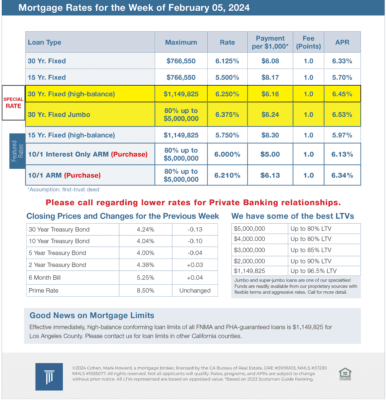

Mortgage Rates for the week of 2-05-2024