Favorable Fed Forecasts

A pivot toward looser monetary policy by the Fed was highly favorable for mortgage markets last week. In addition, the major inflation data was a bit weaker than expected, and mortgage rates dropped to the lowest levels since May.

Fed Anticipate Rate Cuts in 2024

As expected, the Fed made no change in the federal funds rate on last Wednesday, and the statement released after the meeting was very similar to the prior one. The key information was the “dot plot” forecasts from officials. While investors have been pricing in three or four rate cuts next year, officials projected just one in their last set of forecasts three months ago, and recent comments have been mixed on the subject. Officials in fact did shift significantly closer to the outlook of investors, as they now anticipate three 25 basis point rate cuts in 2024. In addition, Chair Powell supported the latest outlook during his press conference, and mortgage rates declined sharply on the prospect of looser monetary policy.

CPI Annual Rate Shows Decrease

The Consumer Price Index (CPI) is one of the most widely followed inflation indicators. Mostly due to lower energy prices, CPI in November was 3.1% higher than a year ago, down from an annual rate of increase of 3.2% last month. To reduce short-term volatility and get a better sense of the underlying inflation trend, investors often prefer to look at core CPI, which excludes the food and energy components. Core CPI was 4.0% higher than a year ago, the same annual rate as last month, the lowest level since September 2021.

Favorable News for CPI

While the core CPI annual rate has fallen from a peak of 6.6% in September 2022, it remains far above the readings around 2.0% seen early in 2021, which is the stated target level of the Fed. Progress in the battle against inflation has been slow due to persistently high prices in certain areas, but this month most of those individual components of the CPI report revealed favorable news. Shelter (housing) costs remained elevated and again were responsible for the largest portion of the increase, but they are easing. Categories which posted large monthly declines included lodging away from home, apparel, and household furnishings.

Gains in Consumer Spending

Despite numerous headwinds such as higher prices and credit card rates, consumer spending has continued to outperform the forecasts of economists. In November, retail sales rose 0.3% from October, well above the consensus for a slight decline. Gains were seen across a wide range of categories, particularly in restaurants/bars, hobby stores, and sporting goods. Retail sales, which are not adjusted for inflation, were 4.1% higher than a year ago, exceeding the increase in prices over that period.

Major Economic News Due This Week

Investors will continue to watch for Fed officials to elaborate on their plans for future monetary policy. For economic reports, Housing Starts will be released on Tuesday. Existing Home Sales will come out on Wednesday and New Home Sales on Friday. Personal Income and the PCE price index, the inflation indicator favored by the Fed, also will be released on Friday.

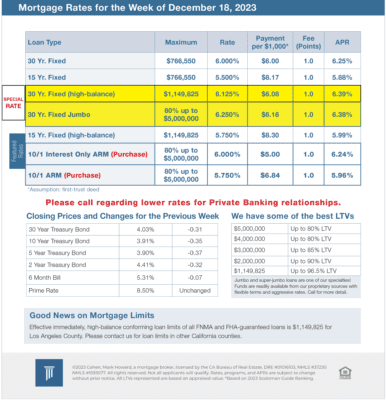

Mortgage Rates for the week of 12-18-2023