Consumer Spending Surges

Stronger than expected economic data was unfavorable for mortgage markets last week. While the latest inflation data was close to expectations overall, consumer spending displayed surprising strength. As a result, mortgage rates climbed to the highest levels since early July.

Core CPI Matches Expectations

The Consumer Price Index (CPI) is one of the most closely watched inflation indicators released each month. To reduce short-term volatility and get a better sense of the underlying inflation trend, investors look at core CPI, which excludes food and energy. In October, Core CPI was 3.3% higher than a year ago, matching the consensus forecast and the same annual rate of increase as last month.

Inflation Remains Elevated

Although this annual rate is down from a peak of 6.6% in September 2022, it is still far above the readings around 2.0% seen early in 2021, which is the stated target level of the Fed. Shelter (housing) costs were 4.9% higher than a year ago and continued to be a primary reason why inflation remains stubbornly elevated. Other categories which posted large monthly increases included airfares, used car prices, and medical care services.

No Surprises with the Latest PPI Report

Another significant inflation indicator released last week, which also measures costs for producers, was essentially in line with the consensus forecast. The core Producer Price Index (PPI) was 3.1% higher than a year ago, up from an annual rate of 2.8% last month. Of the two major inflation reports, investors tend to place less weight on PPI, since it reflects a smaller slice of the economy than CPI.

Consumers Continue to Spend

While many forecasters have been predicting a slowdown in spending by consumers due to higher prices and credit card rates, the latest report indicated that consumer spending remains unexpectedly strong. In October, retail sales rose a solid 0.4% from September, just a little above the consensus forecast, but the results for the prior month were revised significantly higher from an increase of 0.4% to a massive 0.8%. Some of the categories displaying strength included autos, bars/restaurants, appliances, and electronics.

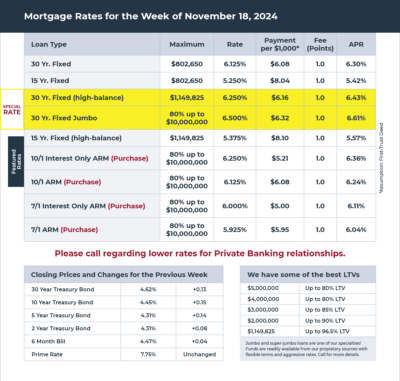

Mortgage Rates for the week of 11-18-2024