Election Shakes Up Mortgage Rates

Not surprisingly, the election had the largest influence on mortgage rates during the highly volatile week last week. The Fed meeting produced the expected outcome and had little impact. In the end, mortgage rates reached their peak last Wednesday but finished last week a little lower overall.

Anticipation of New Economic Policies

Based on the election results, investors adjusted their portfolios to reflect the anticipated economic policies under the new administration, and the changes are expected to be unfavorable for mortgage rates overall. To begin with, economic growth is expected to be stronger, which would increase inflationary pressures. Proposed tariffs also could raise the outlook for future inflation levels. Beyond this, anticipated tax cuts and government spending could increase the budget deficit, requiring the issuance of larger quantities of bonds. Yields generally must rise to persuade investors to purchase additional bonds. These potential policy changes were some of the reasons why mortgage rates rose after (and possibly leading up to) the election.

Fed Reduces the Federal Funds Rate

The last Fed meeting on September 18 was the most highly anticipated in a long time due to the rare uncertainty about the size of the rate cut. The meeting on Thursday was viewed as the opposite extreme with little doubt about the outcome or much chance of surprising comments. As expected, the Fed reduced the federal funds rate by 25 basis points to a target range of 4.50% to 4.75%, and the changes to the meeting statement were relatively minor. According to the statement, the risks to achieving the employment and inflation goals are “roughly in balance.” With inflation easing back down closer to the Fed’s 2.0% target and the labor market softening, officials intend to gradually reduce the federal funds rate from restrictive to more neutral levels. Most investors anticipate that the Fed will cut rates by another 25 basis points at the next meeting on December 18.

The Impact on Mortgage Rates

As a reminder, it is important to distinguish between short-term and long-term interest rates to understand the impact of Fed monetary policy changes on mortgage rates. The Fed controls the federal funds rate, which is essentially the shortest-term lending rate for banks. By contrast, mortgage rates are correlated with long-term interest rates, which are determined by many factors such as the outlook for economic growth and inflation years in the future. As a result, anticipated changes in the federal funds rate such as the one which took place on Thursday rarely have much impact on mortgage rates, as they have already been priced in. Generally, only unexpected changes in the outlook for monetary policy cause a large reaction.

Strong Services Sector Report

The most significant economic report released last week, from the Institute of Supply Management, revealed unexpected strength. The ISM national services sector index rose to 56.0, well above the consensus forecast of 53.7 and the highest level since April 2022. Because readings above 50 indicate an expansion in the sector and below 50 a contraction, this report indicates that consumer demand for services remains resilient despite higher prices.

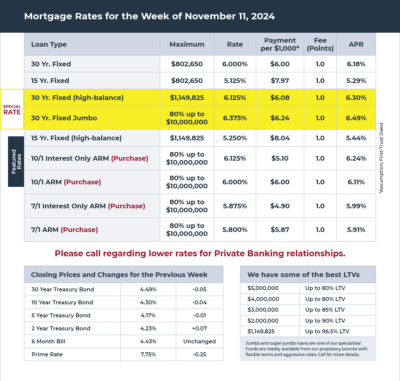

Mortgage Rates for the week of 11-11-2024