Consumer Spending Remains Strong

While the housing market has been suffering greatly, the overall economy has remained remarkably resilient. This last week, consumer spending again was much stronger than expected. As a result, mortgage rates rose sharply, reaching the highest levels in over two decades.

Significant Gains Continue in Consumer Spending

Despite numerous headwinds such as higher prices and credit card rates, consumer spending has continued to exceed the forecasts of economists. In September, retail sales surged 0.7% from August, far above the consensus of just 0.3%. Significant gains were seen across a wide range of categories, particularly in restaurants/bars and motor vehicle parts/dealers. Retail sales, which are not adjusted for inflation, were 3.8% higher than a year ago, roughly matching the increase in prices over that period.

High Mortgage Rates Taking Toll on Housing Market

Higher mortgage rates continue to take their toll on the housing market. Sales of existing homes in September fell a little from August and were 15% lower than last year at this time. This was the slowest sales pace since October 2010. Inventory levels stand at just a 3.4-month supply nationally, far below the 6-month supply typical in a balanced market. The supply of single-family homes available for sale is now at the lowest level since 1982. The median existing-home price of $394,300 was 3% higher than last year at this time.

Housing Market Conditions Fell to Lowest Level

Given the severe shortage of homes in many regions, the data released last week was mostly encouraging. In September, overall housing starts increased 7% from August. Single-family building permits, a leading indicator, rose to the highest level since May 2022. On the flip side, a separate survey of home builder sentiment on housing market conditions from the NAHB unexpectedly fell to the lowest level since January.

Progress in Inflation Battle

A speech by Fed Chair Powell on last Thursday provided no precise guidance on future monetary policy. Essentially, his comments again boiled down to the simple fact that decisions will be based on incoming economic data. He acknowledged substantial progress in the battle against inflation but pointed out that more work needs to be done to get back down to the 2% annual target. According to Powell, achieving this goal is likely to require slower economic growth and “some further softening” of the labor market. Investors remain split about whether there will be another 25 basis point increase in the federal funds rate in coming months.

Major Economic News Due This Week

Investors will continue to watch for Fed officials to elaborate on their plans for future monetary policy. For economic reports, New Home Sales will come out on Wednesday. Third quarter GDP, the broadest measure of economic activity will be released on Thursday. The next European Central Bank meeting also will take place on Thursday. Personal Income and the PCE price index, the inflation indicator favored by the Fed, will come out on Friday.

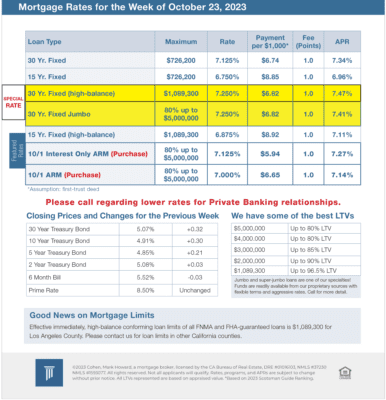

Mortgage Rates for the week of 10-23-2023