Mortgage Rates Hold Steady

After moving significantly higher early in the month due to the much stronger than expected labor market report, mortgage rates began to ease a little during the first half of last week. This was quickly reversed last Thursday, however, when the consumer spending data exceeded expectations. As a result, mortgage rates ended last week nearly unchanged.

Consumer Spending Exceeds Expectations

While many forecasters have been predicting a slowdown in spending by consumers due to higher prices and credit card rates, the latest report indicated that consumer spending remains unexpectedly strong. In September, Retail sales rose a solid 0.4% from August, above the consensus forecast, and the results were even more impressive if volatile auto sales were excluded. Some of the categories displaying strength included clothing and bars/restaurants, while appliances and furniture displayed weakness.

Unemployment Claims Remain Low

The Department of Labor releases the total number of new claims for unemployment insurance each week, and the latest reading was 241,000, well below the consensus forecast and down from a recent high of 258,000 the previous week. Although this suggests labor market strength, these figures are receiving extra scrutiny from investors because of the challenge of removing the effects of the hurricanes.

ECB Cuts Rates Again

At its June meeting, the European Central Bank (ECB) implemented its first rate cut since September 2019. Last Thursday, the ECB again reduced benchmark interest rates by another 25 basis points to 3.25%, as expected, marking its third cut this year. In contrast to the U.S. Fed, which began its current loosening cycle with a larger 50 basis point reduction, the ECB has proceeded in gradual increments of just 25 basis points. The statement released after the meeting again emphasized that future monetary policy decisions will be based on incoming economic data, while providing no specific guidance. According to the statement, the battle against inflation is “well on track” and officials expect to reach their target level next year. Investors anticipate that there will be one more 25 basis point rate cut by the ECB before the end of this year.

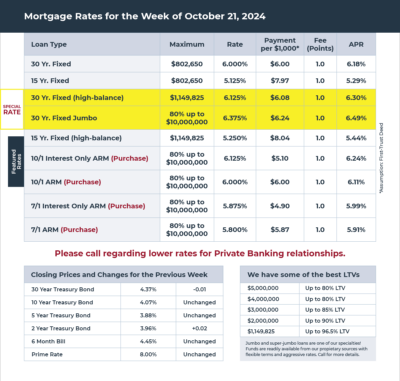

Mortgage Rates for the week of 10-21-2024