Mortgage Rates Continue to Surge Upward

At the start of September, mortgage rates were close to the levels at the start of March and November. In other words, they were high, but they were still well within the range seen over the past year. Rates have climbed significantly higher this month, however, reaching levels not seen in decades.

Short-Term Elevated Rates Hope to Ease Inflation

There are several reasons for the breakout in long-term rates (including mortgage rates) to the upside. Without a doubt, an aggressive stance from the Fed has been one of the biggest factors. Officials currently plan to hold short-term rates at high levels for quite a while to help bring down inflation. Despite the massive monetary policy tightening put in place since the start of 2022, the economy has remained surprisingly resilient. Officials have stated that they are fine if higher borrowing costs slow economic growth and loosen the labor market a bit to help in the battle against inflation.

Bond Supply and Demand Concerns

Concerns about the supply and demand for bonds also have contributed to rising rates. The U.S. government announced a larger than expected budget deficit, and investors do not see much chance of a reduction in spending any time soon, particularly ahead of an election. As a result, the supply of bonds issued by the Treasury will need to increase to fund the spending. Compounding the issue, the Fed is no longer accumulating bonds, as they did during the pandemic to help lower long-term rates. In addition, two of the largest buyers of U.S. bonds, Japan and China, may be slowing their purchases due to their domestic economic conditions. This means that supply is increasing while demand is falling. Yields must adjust by moving higher to persuade additional investors to buy bonds.

Core PCE Up

The PCE price index is the inflation indicator favored by the Fed. In August, core PCE, which excludes food and energy to reduce short-term volatility, was up 3.9% from a year ago, matching the consensus forecast. This was down from an annual rate of 4.3% last month and the lowest level since September 2021. However, it remains far above the Fed’s target level of 2.0%.

Major Economic News Due This Week

Investors will continue to watch for Fed officials to elaborate on their plans for future monetary policy. For economic reports, the ISM national manufacturing index will come out on Monday and the ISM national services sector index on Wednesday. The JOLTS report, measuring job openings and labor turnover rates, will come out on Tuesday. The key Employment report will be released on Friday, and these figures on the number of jobs, the unemployment rate, and wage inflation will be some of the most highly anticipated economic data of the month.

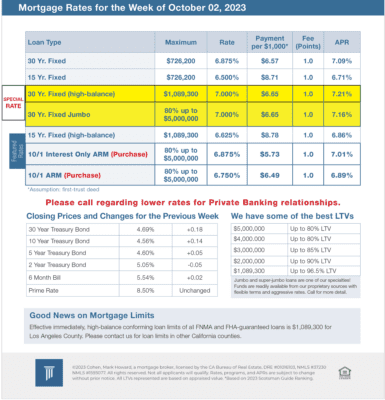

Mortgage Rates for the week of 10-02-2023