Quiet Week

With little major economic data, it was a quiet week last week for mortgage markets, as investors looked ahead to the upcoming Fed meeting. Mortgage rates ended last week nearly unchanged.

Existing Home Sales Rose

In December, sales of existing homes rose modestly from November to the highest level since February and were 9% higher than a year ago. The median existing-home price of $404,400 was up 6% from last year at this time. Inventories remain stuck at historically low levels, standing at just a 3.3-month supply nationally, far below the 6-month supply typical in a balanced market. On a brighter note, though, inventories were 16% higher than a year ago.

Housing Starts Jumped

Additional inventory is still badly needed in many regions, especially at the lower end of the price range, and the headline figure for the latest home building data was surprisingly strong. Overall housing starts in December jumped 16% from November, far above the consensus forecast, to the highest level since February 2024. However, the strength was almost entirely due to volatile multi-family units, which surged 58%. Single-family starts rose just 3%, and single-family building permits, a leading indicator of future construction, increased by an even smaller amount. A separate survey of home builder sentiment on housing market conditions from the NAHB came in close to expectations.

Purchase Applications Rose

The news on mortgage applications last week was somewhat positive. According to the latest data from the Mortgage Bankers Association (MBA), applications to refinance fell 3% from the prior week but were a massive 42% higher than one year ago. Purchase applications rose 1% from the prior week and were up slightly from last year at this time.

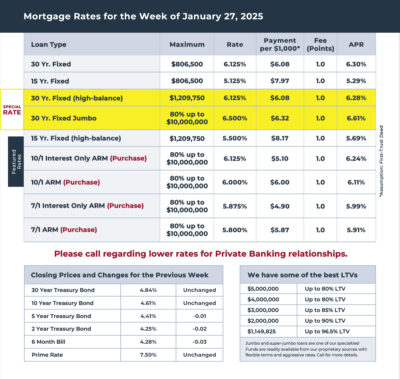

Mortgage Rates for the week of 1-27-2025