Mortgage Rates Lower

The major inflation data released last week was lower than expected, which was favorable for mortgage markets. Consumer spending also was a bit weaker than anticipated, and mortgage rates ended last week lower.

Inflation Trend

The Consumer Price Index (CPI) is one of the most closely watched inflation indicators released each month. To reduce short-term volatility and get a better sense of the underlying inflation trend, investors look at core CPI, which excludes food and energy. In December, Core CPI was 3.2% higher than a year ago, below the consensus forecast and the lowest annual rate since April 2021.

Consumer Price Index

Although this annual rate is down significantly from a peak of 6.6% in September 2022, and from 3.9% in January of this year, it is still far above the readings around 2.0% seen early in 2021, which is the stated target level of the Fed. Shelter (housing) costs continue to be a primary reason why inflation remains stubbornly elevated. New and used car prices also posted large monthly increases, but this was likely due to continued high demand for vehicles to replace those damaged by hurricanes.

Producer Price Index Unchanged

Another significant inflation indicator released last week, which measures costs for producers, also provided a nice surprise on the downside. The December core Producer Price Index (PPI) was unchanged from November, well below the consensus forecast for an increase of 0.3%. Of the two major inflation reports, investors tend to place less weight on PPI, since it reflects a smaller slice of the economy than CPI.

Strong Holiday Shopping Season

Despite higher prices and credit card rates, consumer spending has shown few signs of slowing in recent months. In December, retail sales rose a solid 0.4% from November, a little below the consensus forecast, and were 3.9% higher than a year ago. Particular strength was seen in furniture, autos, apparel, and sporting goods/hobbies. It was another strong holiday shopping season.

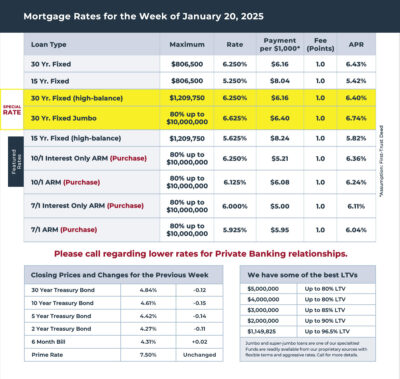

Mortgage Rates for the week of 1-20-2025