Mortgage Rates Ease During Final Weeks of 2022

After two years of exceptionally low mortgage rates, a major change took place in 2022. To help support economies during the pandemic, global central banks and governments flooded the financial system with money, which eventually caused inflation to surge. To bring inflation back under control, central banks had to aggressively tighten monetary policy last year, causing mortgage rates to rise. After starting the year below 3.50%, mortgage rates more than doubled, before easing a bit during the final weeks of 2022.

Fed Commits To Restrictive Monetary Policy

The minutes from the December 14 Fed meeting released on last Wednesday repeated their firm commitment to restrictive monetary policy to fight inflation and revealed that no officials expect any federal funds rate cuts in 2023. According to the minutes, officials observed that it was likely “to take some time” to gain confidence that inflation was on a “sustained downward path” to their stated target level of 2.0%. While both officials and investors expect that additional rate hikes will take place early in the year, some investors anticipate that the Fed will reach its terminal (peak) rate soon and will begin cutting rates late in the year due to slower economic growth.

Wage Growth and Low Unemployment Rate

With Fed officials closely watching for labor market tightness to ease, the economy gained 223,000 jobs in December, the smallest monthly increase in two years. Average hourly earnings, an indicator of wage growth, were 4.6% higher than a year ago, far below the consensus forecast of 5.0% and the lowest level since August 2021. The unemployment rate unexpectedly fell from 3.6% to 3.5%, matching the lowest level in decades. Investors focused mostly on the surprising earnings data, and since slower wage growth reduces inflationary pressures, this report was favorable for mortgage rates.

ISM Service Report Reveals Weak Economic Growth

Two other significant economic reports released this week from the Institute of Supply Management (ISM) revealed weaker economic growth. The ISM national services sector index fell to 49.6 and the ISM national manufacturing index dropped to 48.4. Both readings were the lowest since May 2020, and levels below 50 indicate that the sectors are contracting.

Major Economic News Due This Week

Investors will continue to look for Fed guidance on the magnitude of future rate hikes and bond portfolio reduction. Next week will be a very light one for economic data, with the exception of the highly anticipated CPI inflation data on Thursday. The Consumer Price Index (CPI) is a widely followed monthly inflation indicator that looks at the price changes for a broad range of goods and services.

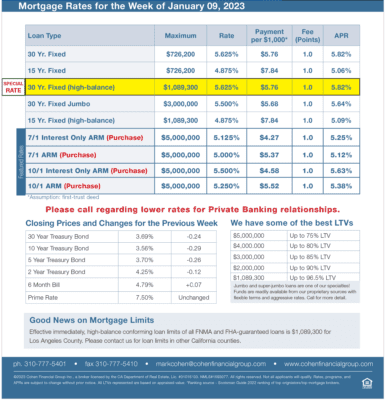

Mortgage Rates for the week of 1-09-2023