Welcome to my February newsletter, featuring personal insights, advice on mortgage rates, and economic news affecting our local housing market.

Mortgage Interest Rates

Let’s start with the U.S. bond markets. Mortgage rates move with 10-year bond yields, which react to big-picture economic concerns. Lately, worries about sustained inflation and international tariffs have kept mortgage rates elevated, though we’ve seen a slight relief in the past few weeks. That said, this is a roller-coaster rate environment. Timing is everything; sometimes, the best rates are only available for a day. That’s why working with an experienced mortgage broker like me is key to locking in the best deal for you or your clients.

Here are some key loan products with competitive rates we have available to meet your needs:

• 5.675% for 7YR jumbo ARMs up to $10M with income documentation, banking relationship required

• 5.875% on a 10YR ARM up to $10M with income documentation, banking relationship required

• Rates for bank statement loans, depending on loan-to-value, are in the high 6’s, low 7’s range, with a strong credit score and a lower loan-to-value

• With strong depository private banking relationship rates in the high 5’s

Employment Reports

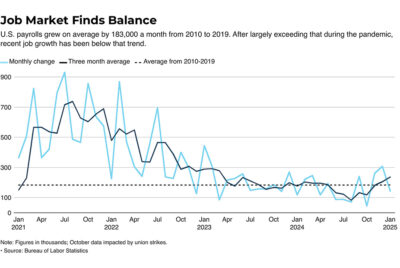

On Friday, the U.S. Bureau of Labor Statistics Employment Summary fell short of expectations, adding 143,000 jobs, but the national unemployment rate declined to 4%, the lowest since May of 2024.

Wage growth rose by 0.5%, up 4.1% year-over-year. Some experts are referring to this as a Goldilocks, report — not too hot, not too cold. The job market remains robust but is now far more normalized than it was leading up to and during the pandemic.

Unemployment Average

California and Los Angeles County are above the national unemployment average, coming in at 5.1% and 5.7%, respectively. Still, it is not exactly an apples-to-apples comparison because California’s reporting is 30 days behind the national numbers. California is in its 56th consecutive month of job expansion. Still, it is almost guaranteed that unemployment resulting from the fires will temporarily halt the expansion trend when the next report comes out in March.

What the data means for mortgage rates – The Fed is keeping an eye on job numbers, specifically looking for them to drop below 100,000 before considering more rate cuts. Right now, the job market is robust, which is a positive for home sales, but also means mortgage rates could stay higher for longer in 2025.

Recent Closed Loans

New Home Purchase | Manhattan Beach | $4.25M

80% LTV financing

5.75% interest rate | 5.84% APR

Established banking relationship

21-day close

New Home Purchase | Newport Beach | $7.5M

75% LTV Financing

5.92% 7YR ARM | 5.98% APR

Full income documentation

Hard Money Construction Loan | Lake Arrowhead | $3.5M

High LTV Financing – 70%

Interest rate 10.5% | APR 10.65%

Full income documentation

DSCR Cash Flow Loan | Elysian Valley

70% cash out

Interest rate 7.125% | APR 7.40%

No tax returns

National Housing & Economic Reports to Watch for This Month:

February 19 – Building Permits, Housing Starts

February 21 – Existing Home Sales

February 26 – New Home Sales

February 27 – Pending Home Sales

As we navigate the aftermath of the devastating fires across Los Angeles County, my heart goes out to all those who have suffered loss. Rebuilding—both physically and emotionally—takes time, and I want to be a resource for anyone in need of guidance, whether it’s understanding financing options, navigating insurance claims, or exploring new housing opportunities.

Despite the challenges, history has shown that our community is resilient. With a strong economy, continued job growth, and unwavering support for one another, better days are ahead. If you or someone you know needs assistance, don’t hesitate to reach out—I’m here to help. Feel free to call me at 310-777-5401.

Sincerely,

Mark Cohen