Rates Tick Up

The biggest economic release last week showed that consumer spending was not quite as weak as forecasted, while the other data had little impact on mortgage markets. As a result, rates ended last week slightly higher.

Consumer Spending Flat

Higher prices and credit card rates appear to finally be slowing the spending of consumers in recent months, although the latest results were not as weak as economists had forecasted. In June, retail sales were flat from May, better than the consensus forecast for a modest decline, and the results for the prior month were revised higher. Looking at individual categories, personal care and building materials showed solid gains, while gas and sporting goods displayed weakness.

Single-Family Construction Declines

Additional inventory is still badly needed in many regions, but the latest home building data was a bit disappointing. While overall housing starts unexpectedly rose 3% from May, the strength was entirely due to a 20% surge in multi-family units. Single-family housing starts dropped for a fourth straight month to the lowest level in eight months. Single-family building permits, a leading indicator of future construction, also declined more than forecasted. In addition, a separate survey of home builder sentiment on housing market conditions from the NAHB unexpectedly dropped to the lowest level of the year.

ECB Holds Rates Steady For Now

Following its first rate cut since September 2019 at its last meeting, the European Central Bank (ECB) made no change in benchmark interest rates on Thursday, as expected. The statement released after the meeting again emphasized that future monetary policy decisions will be based on incoming economic data. Despite the lack of action at this meeting, investors anticipate that there will be two more 25 basis point rate cuts by the ECB before the end of the year.

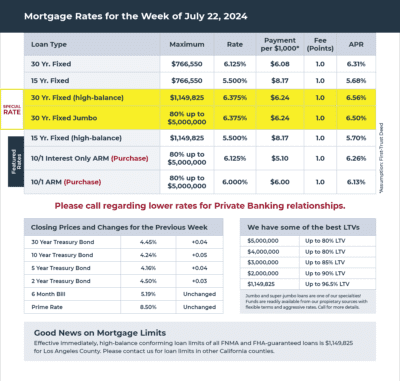

Mortgage Rates for the week of 7-22-2024