As expected, there was not much significant economic news this last week. The data from the housing sector contained no major surprises, and mortgage rates ended nearly unchanged.

Existing home sales data points to a strong seller’s market.

After four straight months of declines, sales of existing homes in June rose modestly from May and were 23% higher than a year ago. Inventory levels were down 19% from a year ago, at just a 2.6-month supply nationally, well below the 6-month supply which is considered a healthy balance between buyers and sellers. The median existing home price was 23% higher than last year at this time, at a new record of $363,300.

All-cash buyers are on the rise.

Several trends have emerged due to the tight conditions in the housing market in many regions. All-cash purchases made up 23% of sales, up from 16% a year ago, and 14% of sales were to investors, up from just 9% last year at this time. Sales of homes priced between $100,000 and $250,000 were 16% lower than a year ago. While low mortgage rates have been favorable, rising prices and competition from investors have made it more difficult for buyers to find affordable homes, especially at the lower end of the market. By contrast, sales of homes priced between $750,000 and $1,000,000 surged 119% during that period.

Housing starts are up but building permits are down.

Given the critical need for more homes in many areas, investors have been closely watching the monthly reports on housing starts, and the latest data contained mixed news. In June, housing starts rose 6% from May and were 29% higher than a year ago. However, building permits, a leading indicator, fell 5% from May to the lowest level since October 2020. Builders say that rising prices and shortages of land, materials and skilled labor are restraining the pace of construction.

Major Economic News Due This Week

Looking ahead, investors will closely watch Covid case counts around the world. They also will look for hints from Fed officials about the timing for changes in monetary policy. Beyond that, New Home Sales will be released today. Second-quarter Gross Domestic Product (GDP), the broadest measure of economic activity, will come out on Thursday. The core PCE price index, the inflation indicator favored by the Fed, will be released on Friday.

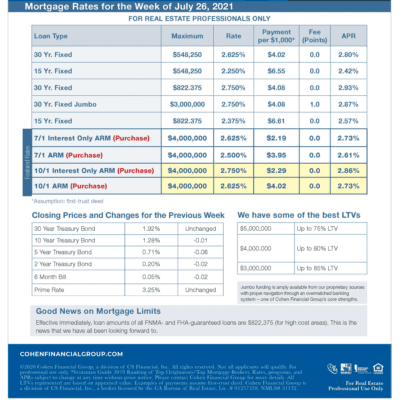

Mortgage Rtes Week of 7-26